Residential buildings in Warsaw, Poland,

Photographer: Piotr Malecki/Bloomberg

Photographer: Piotr Malecki/Bloomberg

It was too good a deal to pass up. Starting nearly two decades ago, Poles got the opportunity to take out mortgages denominated in Swiss francs with interest rates less than half the prevailing level for loans in Polish zloty. More than a million people jumped at the chance. Then in 2015, the Swiss unpegged the franc from the euro and it surged in value, just as the zloty was weakening. Some loans doubled in zloty terms, leaving homeowners with ballooning debt. Tens of thousands sued, and a European court issued a ruling that switched the tide in favor of the plaintiffs, prompting banks to start ratcheting up provisions for legal risks. The long-term impact on Polish banks could be severe, wiping out the equivalent of years of profits. But they may have a chance to shed that burden quicker, as the authorities pile pressure on lenders to reach out-of-court settlements.

1. What made mortgages in Swiss francs so popular?

For decades, Switzerland boasted some of the world’s lowest interest rates, so franc loans were a way for Polish and other eastern European consumers to escape high borrowing costs in their home countries. In 2008, mortgages taken out in zloty had average annual interest rates of about 8.7%, roughly twice that of similar Swiss-franc loans issued by Polish banks. As the global financial crisis pushed borrowing costs in Western countries toward zero, rates on new franc loans fell to 2.7% in 2010, central bank data show. The loans were offered by banks throughout eastern Europe, not just Swiss lenders. In Poland, non-zloty loans peaked at 198 billion zloty ($54 billion) in 2011 and stood at 119 billion zloty in total by late 2020.

2. What’s happened to those mortgages?

With the zloty weakening to an average of around 4.2 against the Swiss franc over the last 12 months (or about $0.27 per zloty) from highs of 2 in 2008, many of these Polish mortgages are now worth more than the underlying property — meaning the homes are, financially speaking, underwater. (This plight also befell franc borrowers in Austria, Hungary and elsewhere.) So far there hasn’t been a flood of defaults on these loans because they’re mainly taken out for primary residences, not vacation homes, so people are prepared to do whatever it takes to pay them back regularly.

3. How many people are affected?

In Poland, more than 430,000 households still have loans in francs or indexed to them, for a total obligation of $24.7 billion. The number, which has been dropping due to repayments, amounts to 20% of all mortgages and 13% of total loans to households, according to data from the Financial Supervision Authority KNF. The plight of Swiss-franc borrowers, known as “Frankowicze,” has been front-page news in Poland for years. In the run up to the 2015 election, they organized themselves into groups that attended parliamentary hearings, pressured politicians and staged protests to seek some form of financial relief.

4. What has the government done?

Starting in 2015, Poland’s financial regulator made it more expensive for banks to hold non-zloty mortgages by forcing them to set aside part of their profits to create capital buffers. The intention was to encourage banks to “voluntarily” convert Swiss-franc loans into zloty at terms acceptable to borrowers. This approach hasn’t worked, triggering frustration among mortgage holders and further lawsuits. The ruling Law & Justice party vowed to resolve the issue when it came to power in 2015 but has not managed to, largely due to fears over the stability of the banking industry.

5. What about the European court case?

One of the lawsuits filed by Frankowicze alleging unfair loan practices came before the European Court of Justice in Luxembourg and was decided on Oct. 3, 2019. The ruling by the European Union’s top tribunal held that if Polish courts determine the mortgage contracts contain unfair terms, EU law would not block annulment of the loan agreements. The decision was seen as a victory for mortgage holders, but its application remains up to national courts in Poland that are yet to work their way through thousands of cases.

6. What’s the latest initiative by authorities?

The banking regulator proposed in December to solve the issue by offering out-of-court settlements, which would convert the loans to zloty at the exchange rate from the start of the agreement, with loan payments recalculated accordingly. Analysts and the banks themselves say that such an operation would cost the industry as much as 40 billion zloty, or nearly three times the industry’s 2019 profit. That compares with more than 90 billion zloty in the worst-case scenario when all customers sue the lenders and win their cases. More than 20,000 borrowers have filed lawsuits, with about 95% winning their cases last year.

7. What are Polish lenders saying?

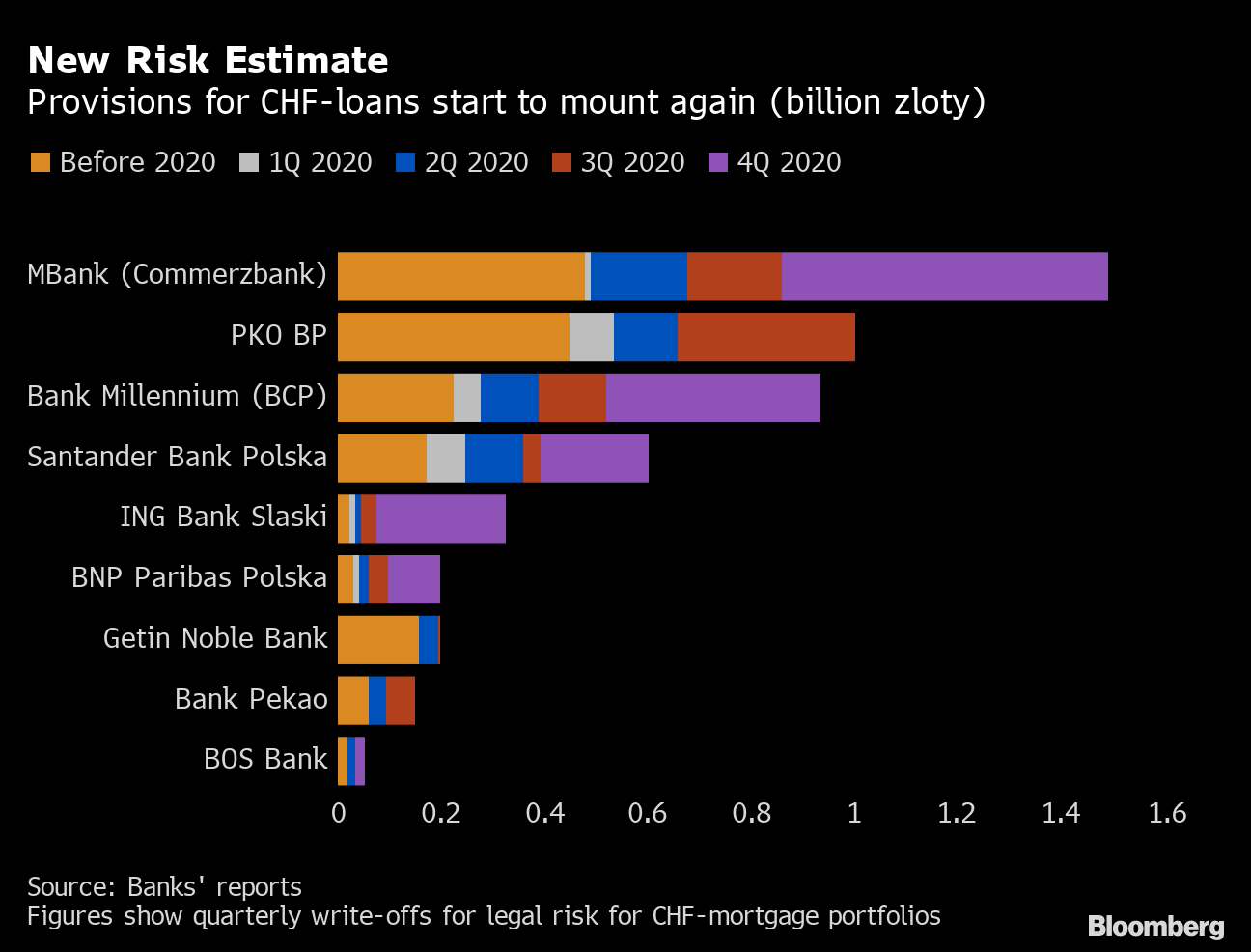

As banks began to lose in court, they hiked their provisions for legal costs even as some executives maintained rhetoric based on the assumption that clients knew what they were getting into when they took out cheaper but more risky non-zloty loans. With write-offs mounting and the regulator nudging lenders to out-of-court deals, several banks — led by PKO Bank Polski SA — started pilot programs for settlements. PKO, the country’s largest bank, said that according to its findings, 70% of clients are looking to strike a deal and exit foreign-currency loans forever. MBank SA Chief Executive Officer Cezary Stypulkowski said the “breakthrough moment” for the loans is near. Banks are becoming more interested in settlements now, rather than in the future, also because the Supreme Court was due to publish guidance soon on such cases. If the tribunal toughens the options for lenders, they may be on the hook for bigger losses.

New Risk Estimate

Provisions for CHF-loans start to mount again (billion zloty)

Source: Banks’ reports

8. What’s needed for the settlements to work

Banks say they still need legal assurances that the proposed settlements won’t be challenged in courts later. The industry is also seeking to ease the conditions attached to receiving central bank help in gaining access to Swiss francs — at market terms — to help unwind their currency positions. To qualify for the aid, lenders need to halt dividends, bonuses and shore up their capital requirements.

9. How have other countries responded?

In 2014, Hungary ordered banks to convert the equivalent of $14 billion in foreign-currency (mostly Swiss-franc) household loans to its national currency, the forint, at a set exchange rate and to offer some refunds to borrowers. A year later, Croatia’s parliament voted to force banks to absorb 6 billion kuna ($960 million) in currency losses by fixing the exchange rate at which banks switched their loans. In 2016, Romanian lawmakers approved a bill to convert Swiss-franc loans into leu at below-market rates, but the law was struck down as unconstitutional by a court and no longer applies.

The Reference Shelf

- A Bloomberg story on Polish banks recognizing potential losses from Swiss franc loans.

- A Bloomberg article on Poland moving to defuse $30 billion Swiss-loan risk to banks.

- A summary of the European Court of Justice ruling on Oct. 3, 2019.

- An advisory opinion to the European Court of Justice from May 14, 2019.

— With assistance by Konrad Krasuski