Making informed decisions about stock market investments requires careful research and understanding of fundamental principles. What to know before investing in stocks has become increasingly important as market volatility and investment opportunities continue to evolve. The right knowledge and tools, like Ziimp, can help investors make better-informed decisions while managing their investment risks effectively.

Ziimp offers essential stock market tracking features that help investors analyze market trends and company performance data. This comprehensive guide examines key investment considerations, including financial goal setting, diversification strategies, and proper use of market information sources. We’ll explore how to evaluate stock market data, understand company fundamentals, and develop responsible investing approaches for both short-term and long-term success.

Understanding Ziimp’s Stock Market Updates

Stock market tracking tools have become essential for modern investors, and Ziimp stands out with its comprehensive suite of portfolio management features. Let’s explore how this platform helps investors stay informed about their investments while understanding some recent updates and changes.

Overview of Ziimp’s stock price tracking features

Ziimp offers a robust set of tools designed to help investors monitor and analyze their portfolios effectively. The platform’s key features include:

- Smart Alerts System for managing entry and exit levels

- Stock Score Analytics ranking stocks against peers on a 0-100 scale

- Portfolio Visualization tools for performance tracking

- KPI Tracking showing fundamental indicators and comparison metrics

- Real-time Portfolio Management with asset allocation insights

The platform’s fundamental view provides crucial metrics like margin, ROE, revenue growth, and analyst targets, making it easier for investors to make informed decisions about what to know before investing in stocks.

Recent issues with daily price updates

While Ziimp strives to provide timely information, there are some important limitations regarding daily price updates that users should be aware of. The platform’s historical data typically updates only after a trading day completes, which means current-day trading details aren’t immediately available. This delay is partly due to data provider relationships and market closing procedures.

Real-time quote data updates every three minutes, but the historical data compilation requires additional processing time. Users should note that major indices experience at least a one-minute delay, which is standard across many financial platforms.

How historical data is affected

Historical stock price data undergoes regular revisions to maintain accuracy and reflect corporate actions. These adjustments are crucial for several reasons:

Stock prices are routinely adjusted for various corporate events, including:

- Dividend payments: Removing sudden drops in prices on ex-dividend dates

- Stock splits: Adjusting historical prices to reflect share consolidation

- Spinoffs: Accounting for company separations and value distribution

- Mergers: Reflecting organizational changes

The adjustment of historical data serves to present a more accurate picture of investment performance over time. For instance, when a company conducts a spinoff, the share price naturally drops by the value of the new company. Without proper adjustments, this could appear as a significant loss in raw price data, when in reality, shareholders received compensating value in the form of shares in the new company.

These modifications ensure that current data remains comparable to past performance metrics, providing investors with a clearer understanding of their investments’ true historical performance. The magnitude of these adjustments is determined by publicly available information detailing the terms of corporate actions.

Key Factors to Consider Before Investing

Before diving into stock investments, understanding crucial investment fundamentals can make the difference between success and failure in the markets. Let’s explore the essential factors every investor should consider.

Assessing your financial goals and risk tolerance

Your investment journey begins with a clear understanding of your financial objectives and comfort level with market volatility. Risk tolerance comprises two key elements: your willingness to accept potential losses and your ability to withstand market fluctuations based on your financial situation.

Consider these fundamental questions:

- What is your investment time horizon?

- How much of your portfolio can you afford to risk?

- What level of market volatility can you emotionally handle?

- Are your financial goals aligned with your risk capacity?

Importance of diversification

Diversification serves as a cornerstone of responsible investing, helping to reduce portfolio risk without necessarily sacrificing potential returns. A well-diversified portfolio typically contains 20-30 different stocks across various industries, along with other asset types like bonds, funds, and potentially real estate investments.

The power of diversification lies in owning assets that perform differently under various economic conditions. When some investments decline, others may remain stable or increase, helping to smooth out your overall returns. This approach is particularly crucial when what to know before investing in stocks includes understanding how to protect your capital during market downturns.

Understanding market trends and company fundamentals

Successful stock investing requires a solid grasp of both market trends and company fundamentals. When analyzing individual stocks, focus on these key metrics:

| Fundamental Metric | What It Measures | Why It Matters |

|---|---|---|

| P/E Ratio | Price relative to earnings | Valuation assessment |

| Revenue Growth | Sales increase over time | Business momentum |

| Return on Equity | Profitability efficiency | Management effectiveness |

| Debt-to-Equity | Financial leverage | Risk assessment |

Beyond individual metrics, understanding broader market trends helps inform your investment decisions. Fundamental analysis examines a company’s financial statements, competitive advantages, and industry position to determine its intrinsic value. This approach often reveals insights that pure price analysis might miss.

When evaluating market trends, consider both short-term and long-term perspectives. While daily price movements might capture headlines, successful investors typically focus on longer-term trends that align with their investment goals. Use tools like Ziimp’s fundamental analysis features to track these metrics effectively and make more informed investment decisions.

Remember that market trends can shift rapidly, making it essential to regularly review your investment thesis and adjust your strategy when necessary. Focus on identifying companies with strong fundamentals that align with your risk tolerance and investment timeline rather than chasing short-term market movements.

Navigating Stock Market Information Sources

In today’s digital age, the abundance of financial information can be both a blessing and a curse for investors. Knowing how to navigate through various information sources is crucial for making well-informed investment decisions.

Evaluating the reliability of financial news and expert opinions

The credibility of financial news varies significantly across different sources. When evaluating financial news and expert opinions, consider these key factors:

| Information Source | Reliability Factors | Red Flags to Watch |

|---|---|---|

| Financial News | Source reputation, data verification | Sensational headlines, undisclosed conflicts |

| Expert Analysis | Track record, compensation structure | Hidden agendas, lack of transparency |

| Social Media | Verified credentials, historical accuracy | Anonymous sources, pump-and-dump schemes |

It’s essential to understand that financial tabloids aim to provide authentic information, but their recommendations should be cross-verified. Media acts as an intermediary between investors and markets, making it crucial to distinguish between reliable reporting and potential misinformation.

Using Ziimp for unbiased market insights

Ziimp’s platform stands out by providing objective market analysis through its comprehensive data-driven approach. The platform offers:

- Real-time market data with minimal delay

- Comparative analysis tools for peer company evaluation

- Automated alerts for significant market changes

- Historical performance tracking with adjusted data

What makes Ziimp particularly valuable is its focus on presenting unbiased information without the influence of advertising or sponsored content. The platform’s algorithms analyze multiple data points to provide a balanced view of market conditions, helping investors make more informed decisions about what to know before investing in stocks.

The role of company filings and reports in decision-making

Official company filings represent the most reliable source of financial information. The Securities and Exchange Commission (SEC) requires public companies to submit various documents that provide crucial insights into their operations and financial health.

These mandatory filings serve as the foundation for fundamental analysis:

Form 10-K: Annual reports containing comprehensive financial statements and business operations details. These documents undergo independent auditing, ensuring higher reliability compared to other information sources.

Form 10-Q: Quarterly updates that provide more frequent insights into company performance. While less detailed than 10-K reports, these filings help investors track ongoing business developments.

Form 8-K: Real-time disclosures of significant events that could impact stock value. These reports offer timely information about major corporate changes or unexpected developments.

Understanding these documents requires some financial literacy, but they provide the most accurate picture of a company’s health. When combined with Ziimp’s analytical tools, investors can better interpret these filings and identify potential investment opportunities or risks.

Remember that successful investors typically rely on multiple information sources while giving more weight to official filings and verified data. By cross-referencing different sources and using Ziimp’s unbiased analysis tools, you can build a more complete understanding of potential investments and make better-informed decisions in the stock market.

Strategies for Responsible Stock Investing

Successful investing requires a well-thought-out strategy that aligns with your financial goals and risk tolerance. Understanding different investment approaches and implementing proven strategies can significantly impact your portfolio’s performance over time.

Long-term vs short-term investment approaches

The distinction between long-term and short-term investing goes beyond just timeframes – it encompasses different strategies, risk levels, and potential returns. Here’s how these approaches compare:

| Aspect | Long-term Approach | Short-term Approach |

|---|---|---|

| Time Horizon | 5+ years | Less than 1 year |

| Risk Profile | Generally lower volatility impact | Higher sensitivity to market swings |

| Investment Focus | Company fundamentals | Market timing and trends |

| Tax Implications | Lower capital gains rates | Higher tax burden |

Long-term investing typically aligns better with wealth-building goals, allowing investors to weather market volatility while benefiting from compound growth. This approach requires patience and discipline, focusing on fundamental analysis rather than short-term price movements.

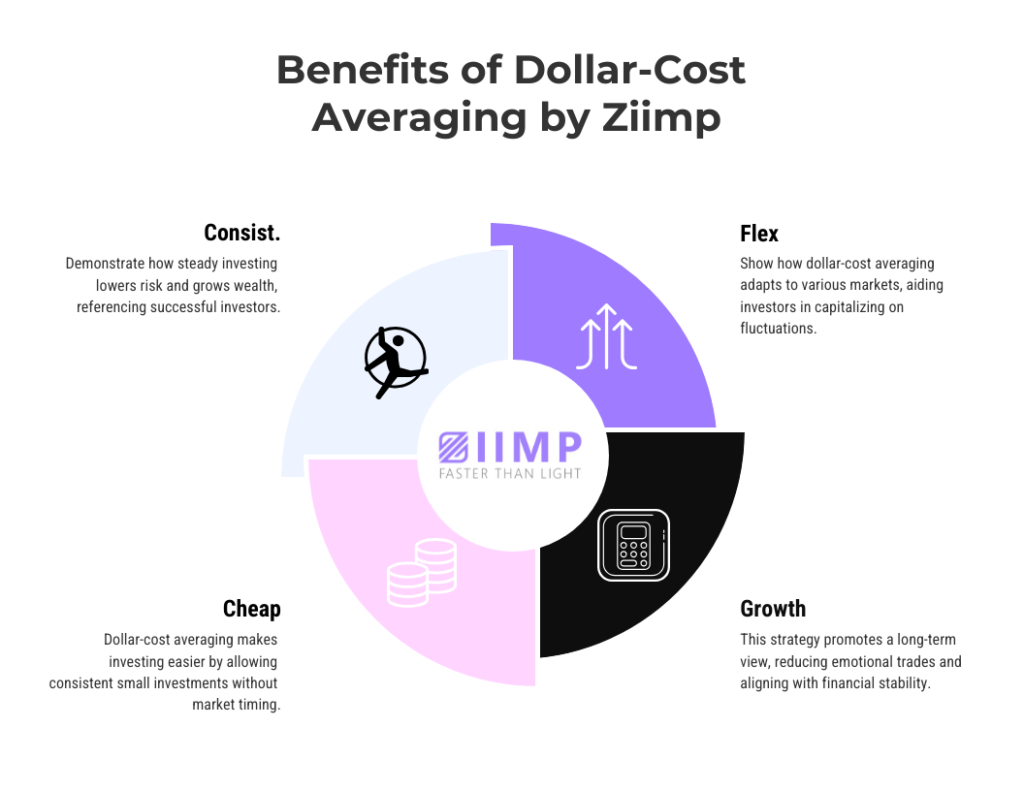

The power of dollar-cost averaging

Dollar-cost averaging (DCA) stands out as one of the most effective strategies for what to know before investing in stocks. This systematic approach involves investing fixed amounts at regular intervals, regardless of market conditions.

Key benefits of dollar-cost averaging include:

- Reduced impact of volatility on your portfolio

- Natural buying of more shares when prices are low

- Elimination of emotional decision-making

- Consistent investment discipline

- Lower average cost per share over time

The strategy proves particularly effective during market uncertainty, as it removes the pressure of trying to time the market perfectly. When implementing DCA, investors naturally buy more shares when prices are lower and fewer shares when prices are higher, potentially leading to better long-term returns.

Setting realistic expectations for returns

Understanding historical market performance helps set realistic investment expectations. Based on comprehensive market data, investors should consider several key factors when projecting potential returns:

The S&P 500 has historically returned approximately 10% annually before inflation, but this figure requires context. Real returns (after inflation) typically range between 5-6% over the long term, which provides a more realistic baseline for investment planning.

Important considerations for return expectations:

- Market conditions and current valuations affect future returns

- Individual portfolio composition influences overall performance

- Time horizon significantly impacts investment outcomes

- Risk tolerance should guide return expectations

Professional investors and financial experts typically estimate more conservative returns than retail investors. While individual investors might expect returns of 14.5% above inflation, financial professionals generally project closer to 5.3% above inflation for long-term performance.

To maintain responsible investment practices, consider these proven strategies:

- Maintain consistent investments regardless of market conditions

- Diversify across different asset classes and sectors

- Focus on long-term performance rather than short-term fluctuations

- Regularly review and rebalance your portfolio

Remember that expectations should align with your investment timeline and risk capacity. Short-term investors face greater uncertainty in achieving average market returns, while longer investment horizons typically provide more predictable outcomes.

The investment world contains significant noise that can affect your return expectations. Form realistic projections based on historical data, proper comparisons, and factors such as time horizon and risk tolerance. This approach helps create a more sustainable and successful investment strategy aligned with your financial goals.