Photographer: Roberto Monaldo/LaPresse/Bloomberg

Photographer: Roberto Monaldo/LaPresse/Bloomberg

European bonds gave Mario Draghi a seal of approval last week. The euro suggests he’s not quite the silver bullet for the region’s challenges.

As Italy’s debt markets were breaking records off the back of Draghi’s appointment as Premier-designate, the euro endured a second week of declines and fell below $1.20. It’s a sign that the currency bloc’s problems may be more ingrained than the fate of its third-largest economy.

“The only supportive elements for the euro at the moment are really the somewhat hawkish European Central Bank,” said James Athey, a money manager at Aberdeen Standard Investments. “The euro will likely head down to $1.17.”

A return to calm in Italian politics after a bout of turmoil usually tends to boost the euro. Not so this time, despite Draghi’s credentials as head of the ECB for nearly a decade and as the man largely credited with saving the currency bloc. It was certainly a boon for Italian bonds and some its periphery peers, as well its stock markets.

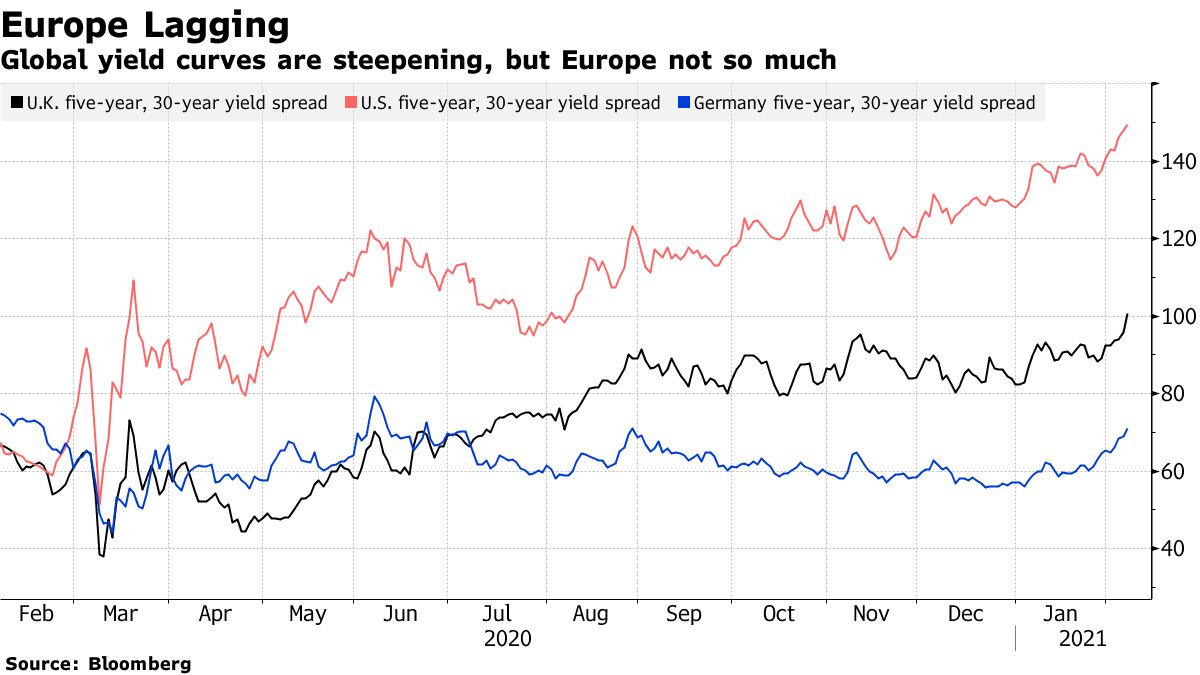

Yet currency investors are realizing the pandemic is exerting greater force over the euro. Europe has been left behind in the vaccine race by the U.S. and U.K., whose immunization programs are rocketing along. Hopes for a rapid recovery in these countries have steepened bond yields, resulting in flows into the dollar and the pound at the expense of Europe’s common currency.

Instead of positioning for the euro to appreciate, investors are scaling back longs, according to Societe Generale SA. Three-month risk reversals, an options gauge of positioning and sentiment, show that traders are the most bearish on euro-dollar since June last year. Versus the pound, it’s the most since March.

“Better U.S. versus European growth has been a catalyst for those positions to get squeezed out,” Kit Juckes, a strategist at Societe Generale, said in reference to euro longs. “And we can’t build a base for more euro strength without getting them down.”

Europe’s Challenges

Europe has administered just over three vaccine doses per 100 people, compared to over 16 in the U.K. and over 11 in the U.S. That’s of particular concern for Italy, where debt as a share of economic output has risen close to 160%, second to Greece as the highest in the euro area. One of Draghi’s priorities will be how to spend its package of grants and loans from the euro area to help turn that around.

Read More: More Than 119 Million Shots Given: Covid-19 Tracker

Europe’s challenges have been captured by its deeply negative real rates, which reflect the return investors receive once inflation is stripped out. Expectations for price increases in the region have climbed, yet yields have not kept pace, thanks to the weight of European Central Bank bond buying.

So while real yields in the U.S. have stayed broadly steady, Germany’s are plumbing record lows, resulting in the widest gap between the two since May. And it’s a dynamic that has dimmed investors’ optimism in the euro, according to Societe Generale.

| What Bloomberg Intelligence says |

|---|

|

“Negative real yields highlights financial repression as central bank guidance constrains nominal yields from rising and target higher inflation. Investors get double punched and forces them to take on more risk and reach for yield amid low volatility.” — Tanvir Sandhu, Chief Global Derivatives Strategist |

Expect Weakness

Indeed, the euro has lost the momentum that took it to the highest level versus the dollar since 2018 last month. The region is facing a loss of economic output potentially to the tune of 100 billion euros ($120 billion), should it take longe rto close its vaccination lag. Deutsche Bank AG and Nomura International Plc are among banks recommending investors position for even more weakness.

But that hasn’t dented interest in opportunities in European bond markets. Mohammed Kazmi, portfolio manager and macro strategist at Union Bancaire Privée, sold German bund futures last week on the news that Draghi had been asked to form a government. There’s room for periphery bonds to attract flows from the core, Kazmi said.

If Italy manages to avoid fresh elections in the near-term, the outlook for its debt is healthy. Citigroup sees the country’s 10-year yield spread versus Germany hovering near 100 basis points — a milestone hit for the first time since 2016 — should Draghi garner backing from either the Five Star Movement or the League parties. The gap could double though in the event of a new vote, and the ECB doesn’t accelerate the pace of bond purchases, they said.

“Markets can take confidence from Draghi’s actions of the past, where he clearly understood market dynamics,” Union Bancaire’s Kazmi said.

This week

Bond auctions from Germany, Italy and the Netherlands are expected to total over 20 billion euros, according to Citigroup. There are no redemptions until Feb. 25, when France is due to pay around 17 billion euros; there are also no coupons payable next week.

- The market friendly environment may spur Italy to sell debt via banks in the near-term according to UniCredit SpA with a 20-, 30-, 50-year bond or an inflation-linked note possible

- The U.K. will sell 2 billion pounds of conventional 20-year bonds and offer a new 30-year inflation-linked note via banks. The Bank of England will buy back 4.4 billion pounds of debt in three operations

- Data is mostly backward looking with the exception of the euro-area Sentix investor confidence number on Monday

- All the U.K. data is on Friday with 4Q and December GDP figures likely to draw all the attention

- The pace of ECB speakers picks up slightly next week with two speeches by Francois Villeroy on Monday and Thursday sandwiching a speech by Fabio Panetta on Wednesday, while Klaas Knot also speaks Thursday

- There are no BOE speakers scheduled to speak next week

- DBRS Ltd. reviews Belgium; Moody’s Investors Service reviews Ireland on Friday

— With assistance by Ksenia Galouchko