Treasury yields retreated from their highest in a year on Wednesday, while European stocks edged lower as investors assessed a busy day for earnings.

The Stoxx 600 Index slipped amid a mixed bag of corporate results. Kering dragged retail shares lower after its Gucci brand missed estimates, and British American Tobacco Plc slid following its full-year results. Rio Tinto Group climbed after reporting a 20% jump in annual profit on a surge in iron ore prices.

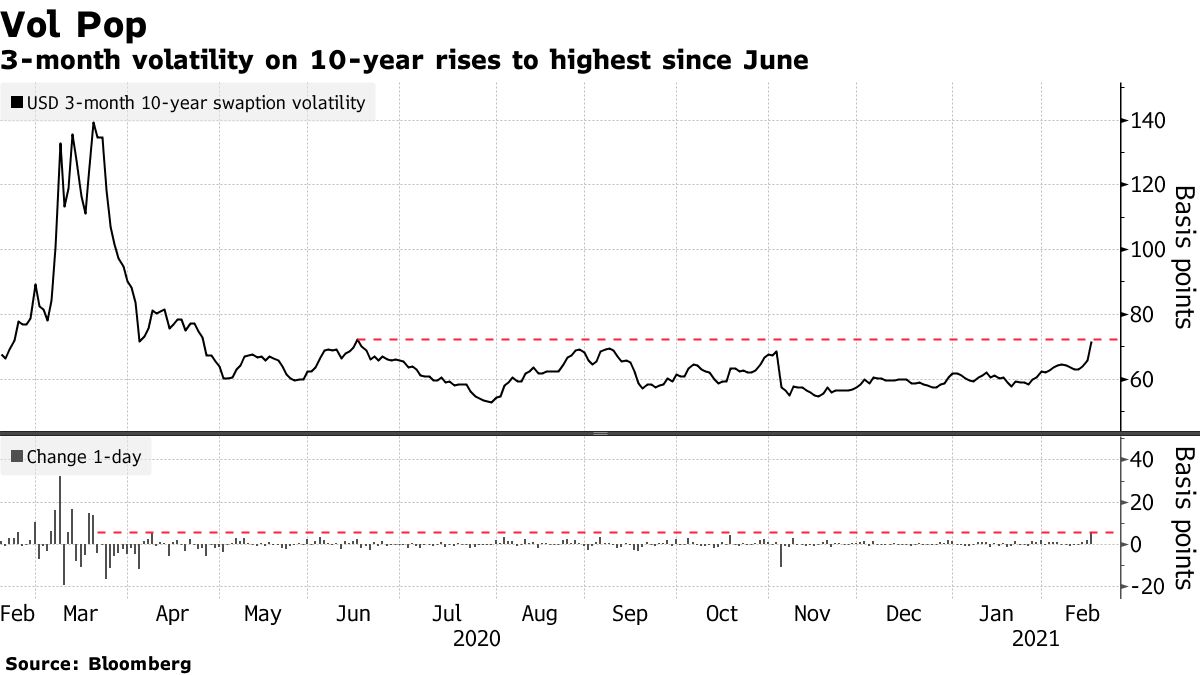

S&P 500 futures were flat, while the yield on benchmark 10-year Treasuries dipped to around 1.28% after touching the highest since February 2020. The three-month implied volatility on 10-year swap rates jumped, signaling that U.S. Treasuries are in for more wild gyrations. The dollar strengthened.

The dramatic rise in bond yields has investors wondering afresh how high they can climb before spoiling the risk rally. Meanwhile, speculative euphoria in assets like Bitcoin and positive sentiment readings have some strategists calling for a pause. Given “ebullient sentiment readings, stretched valuation levels and slipping earnings revision momentum,” a 10% pullback in U.S. shares is plausible, according to Tobias Levkovich, Citigroup Inc.’s chief U.S. equity strategist.

Read More: Yield Surge Stirs Debate on Breaking Point for Everything-Rally

“The market is fairly frothy here from a sentiment perspective,” Liz Ann Sonders, chief investment strategist at Charles Schwab & Co., said on Bloomberg TV. “You have to put a move higher in yields that goes out of the comfort zone as a potential risk associated with that.”

Elsewhere, oil fluctuated around $60 a barrel in New York amid a deepening energy crisis in the U.S. Bitcoin climbed back above the $50,000 level. China remains shut for a week-long holiday and will reopen Thursday.

Vanessa Martinez, managing director and partner at The Lerner Group, discusses the current state of markets and why she thinks a correction is needed.

Markets: China Open.” (Source: Bloomberg)

Here are some key events coming up:

- Earnings roll on with companies including Daimler, Credit Suisse, Deere, Danone and Nestle.

- Federal Open Market Committee minutes from the January meeting are due Wednesday.

- U.S. retail sales figures come on Wednesday.

Here are the main moves in markets:

Stocks

- Futures on the S&P 500 Index were little changed at 9:06 a.m. London time.

- The Stoxx Europe 600 Index sank 0.2%.

- The MSCI Asia Pacific Index increased 0.1%.

- The MSCI Emerging Market Index advanced 0.4%.

Currencies

- The Bloomberg Dollar Spot Index gained 0.1%.

- The euro decreased 0.2% to $1.2077.

- The British pound was little changed at $1.3897.

- The onshore yuan weakened 0.4% to 6.458 per dollar.

- The Japanese yen strengthened 0.1% to 105.90 per dollar.

Bonds

- The yield on 10-year Treasuries fell three basis points to 1.28%.

- The yield on two-year Treasuries declined less than one basis point to 0.12%.

- Germany’s 10-year yield dipped one basis point to -0.36%.

- Britain’s 10-year yield fell two basis points to 0.605%.

- Japan’s 10-year yield climbed one basis point to 0.099%.

Commodities

- West Texas Intermediate crude increased 0.7% to $60.47 a barrel.

- Brent crude gained 0.9% to $63.94 a barrel.

- Gold weakened 0.3% to $1,789.25 an ounce.

— With assistance by Stephen Spratt