Photographer: Kiyoshi Ota/Bloomberg

Photographer: Kiyoshi Ota/Bloomberg

U.S. equity futures began the week on the front foot after climbing to a record last week, as investors monitored comments from Janet Yellen pushing a stimulus bill as well as an improvement in coronavirus trends. The dollar steadied after Friday’s slide.

S&P 500 Index futures ticked up after the gauge hit an all-time high on Friday, closing up almost 5% on the week. Asian contracts pointed to a mixed start for stocks in Japan and Hong Kong, while Australian shares rose. Treasury Secretary Yellen said on Sunday talk shows that the U.S. can return to full employment in 2022 if it enacts a robust enough relief package. Ten-year Treasury yields crept higher last week to trade around 1.16%. Crude oil extended recent gains.

Investors are taking comfort from the continued rollout of vaccines and data suggesting a declining trend in infections in countries like the U.S. and Germany. While the weaker-than-forecast U.S. jobs data Friday reinforced the fragility of the recovery as the pandemic lingers, it reinforced the case for further stimulus.

“It does seem to be the case that global markets have now become addicted to stimulus and that the greatest risk to the outlook — and potential trigger for a correction in risk-asset valuations — would be central banks dialing down the music,” said Simon Ballard, chief economist at First Abu Dhabi Bank Pjsc.

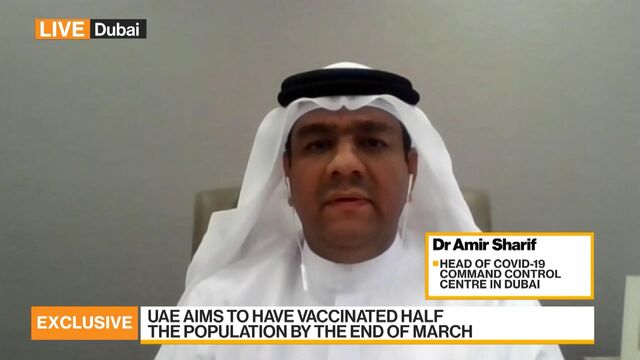

Dr. Amer Sharif, Head of Dubai’s COVID-19 Command & Control Centre, discusses the UAE’s goal to vaccinate half its population by the end of March.

Here are some key events coming up:

- Earnings season continues with companies including Honda Motor, SoftBank Group, Cisco Systems, Commonwealth Bank of Australia, Societe Generale, Commerzbank and L’Oreal.

- EIA crude oil inventory report comes Wednesday.

- Sweden will set monetary policy on Wednesday.

- Federal Reserve Chairman Jerome Powell will speak on a webinar Wednesday.

- The U.S. consumer price index comes Wednesday.

- Lunar New Year public holidays being in nations across Asia, with China breaking for a week.

- Bank of Russia’s policy decision comes Friday.

These are the main moves in markets

Stocks

- S&P 500 futuresa added 0.4% as of 8:03 a.m. in Tokyo. The gauge rose 0.4% on Friday.

- Futures on Japan’s Nikkei 225 closed little changed on Friday.

- Hang Seng Index futures added 0.2% on Friday.

- Australia’s S&P/ASX 200 Index rose 0.2%.

Currencies

- The yen was at 105.41 per dollar.

- The offshore yuan was at 6.4607 per dollar.

- The euro bought $1.2051.

Bonds

- The yield on 10-year Treasuries ended above 1.16% on Friday.

Commodities

- West Texas Intermediate crude oil gained 0.5% to $57.14 a barrel.

- Gold was at $1,817.32 an ounce, up 0.2%.

— With assistance by Sophie Caronello