Subscribe to The Financial Brand via email for FREE!

Transaction account data often can pinpoint defections of consumer deposits into someone’s mutual fund or another institution’s CD, but it’s harder to know when one of your checking customers decides to take out a loan or a credit card with another financial institution. Turns It turns out more people are doing that.

As consumers have become more comfortable doing things digitally — especially since the start of the pandemic — the friction that used to hold people back from buying financial products at a competitor has all but disappeared. It doesn’t help that the new crop of digital-only financial institutions tends to compete on both price as well as ease and speed of application.

So even though the rate of consumers switching primary institutions (where they keep their checking account) is still low — around 6% according to Novantas — that isn’t the whole picture. Various sources, including Raddon and Cornerstone Advisors, have noted that consumers are much more open to having accounts or banking products scattered among multiple providers than they were in the past (dig deeper).

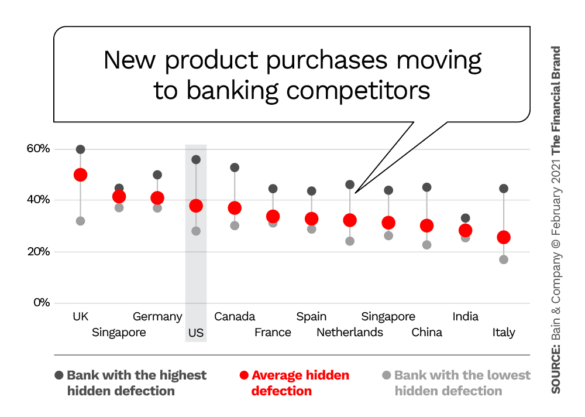

Data from a massive global survey of consumers by Bain & Company confirms what the firm calls the “hidden defection” of consumers. In a survey of about 56,000 consumers in 11 countries, Bain found that anywhere from a quarter to half of all banking purchases go to financial institutions that are not the consumer’s primary bank. The percentages vary by country as indicated in the chart below. Digital channels are the most common means of making these purchases.

The U.K., with its highly competitive banking market, populated by numerous challenger banks, has the highest average “defection” rate, at 51%. In the U.S. the figure is 38%.

Key Insight:

In the U.S., it is loans and credit cards that consumers say they purchase most often at a secondary institution (54% and 50% respectively). For deposits, by contrast, the figure is just 22%.

Why Consumers Look Beyond Their Primary Bank

Many factors contribute to consumers buying banking products elsewhere, Bain found, but one reason stood out: “A more affordable product.” That was cited by 53% of the respondents while the next three highest responses — all at 36% — were: “Better digital tools,” “Simpler purchase process” and “More convenient.”

Younger customers put a greater emphasis on digital tools, convenience, branding and security, Bain noted. For the respondents overall, “Better brand” and “Better security” were mentioned as reasons for reaching out to other institutions by 33% and 30% of respondents, respectively.

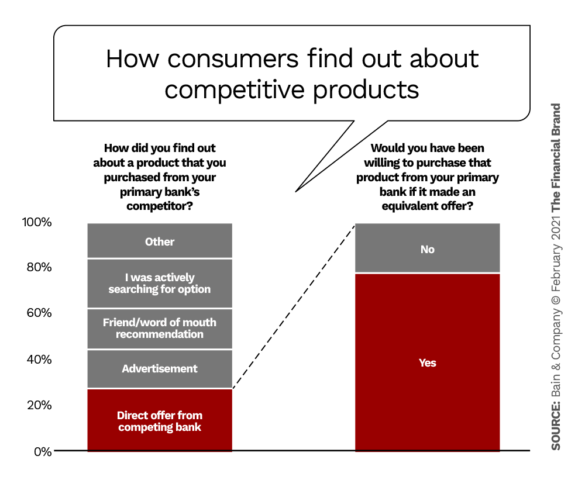

In just under a third of the cases (29%) consumers went with another institution because of a direct offer they had received.

Reality Check:

More than three quarters (78%) of consumers receiving direct offers from a competitive institution say they would have been willing to stick with their primary provider if they had been give an equivalent product offer.

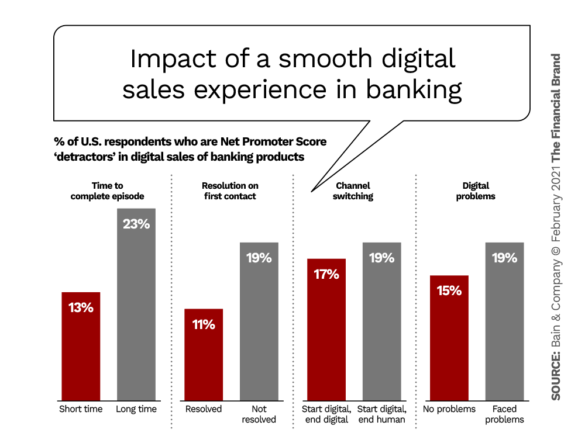

Bain found significant differences in hidden defection rates between financial institutions that were leaders or laggards in terms of how efficient and easy their digital sales experience is. Bain originated and owns the Net Promoter Score performance metric and incorporated that measure in its research. People who rate a sales experience below a certain level are “detractors” in NPS parlance. In the chart below it’s clear that certain combinations of factors experienced during account opening or loan origination are more likely to turn someone into a detractor, and hence more susceptible to looking elsewhere.

The most significant factor was how long it took to complete the process. Too long a time (however the consumer defined that) resulted in a much higher percentage of detractors.

Read More:

REGISTER FOR THIS FREE WEBINAR

Improve Financial Services Communications

Learn what you need to know about the new reality of customer expectations in order to deliver the best possible customer experience

Wednesday, March 3rd 2pm (ET)

Secondary Accounts May Only be Step One

The Bain research found far less switching of primary deposit accounts by consumers, but other research indicates a pickup in that area, at least in the U.S. Consumer research by Cornerstone Advisors found that the number of Gen Z and Millennial consumers who considered a checking account held at challenger bank such as Chime to be their primary account had increased from 4% at the beginning of 2020 to 15% by the end of that year. By Cornerstone’s reckoning Chime had nearly eight million primary customers at yearend 2020, putting it almost on par with Citibank.

Even if consumers don’t move their checking account (or deposit dollars), Bain observes that the economic impact of the loss of even “secondary” products is significant, because they are often high-margin credit products.

Bain puts particular emphasis on the marketing efforts of banks and credit unions as a way to stop or slow the rate of defection. Institutions should remove friction from their sales and account opening so that consumers don’t feel compelled to shop around, the firm states.

“Primary banks have the best information about their current customers. Such information forms the basis for personalized offers that appeal.”

— Bain & Company

In addition to personalized offers, the consulting firm points out the importance of being able to complete a purchase on the first contact. At any point in the sales funnel, Bain says, a glitch or delay can prompt a prospective buyer to move on to someone else.